Who's who on UK banknotes

The Business 2 Community website has published a nice infographic on the banknotes issued in the United Kingdom and who's on them. Because of the size of the image, click below.

The Business 2 Community website has published a nice infographic on the banknotes issued in the United Kingdom and who's on them. Because of the size of the image, click below.

Besides presenting the new 10 euro note, the ECB Executive Board member Yves Mersch also had other news on the euro. Most important for us collectors is the confirmation that there won't be a switch to polymer banknotes in the near future. "We have seen with great interest what the Bank of England does and also what other central banks have been doing around the world, and we are studying their experiences," Mersch told a news conference when presenting the new 10 euro banknote. "The outcome of our studies was that we would remain with ... the current series," he said.

Besides presenting the new 10 euro note, the ECB Executive Board member Yves Mersch also had other news on the euro. Most important for us collectors is the confirmation that there won't be a switch to polymer banknotes in the near future. "We have seen with great interest what the Bank of England does and also what other central banks have been doing around the world, and we are studying their experiences," Mersch told a news conference when presenting the new 10 euro banknote. "The outcome of our studies was that we would remain with ... the current series," he said.

The other bit of news was the number of fake euro banknotes pulled from circulation. The number of fake notes in the second half of last year rose by 11.4 percent from the first half to 353,000. Although this is the highest number since 2010 it's not that much when you consider there are 15 billion banknotes in circulation.

The other bit of news was the number of fake euro banknotes pulled from circulation. The number of fake notes in the second half of last year rose by 11.4 percent from the first half to 353,000. Although this is the highest number since 2010 it's not that much when you consider there are 15 billion banknotes in circulation.

The new 10 euro won't help much in the fight against counterfeiting because the 20 and 50 euro notes are by far the most favorite notes to forge. The 20 euro will be the next note in the Europa series. Its presentation date is unknown at this time but we're probably looking at 2015 for that one.

Recently there has been a rise in the amount of fake notes in Hong Kong. Specifically the higher denominations are counterfeited. This article explores the possible consequences for the confidence in the Hong Kong dollar. It also asks the question if a move to more polymer notes could have prevented this influx of fake notes. My guess is: yes!

Recently there has been a rise in the amount of fake notes in Hong Kong. Specifically the higher denominations are counterfeited. This article explores the possible consequences for the confidence in the Hong Kong dollar. It also asks the question if a move to more polymer notes could have prevented this influx of fake notes. My guess is: yes!

At this moment Hong Kong only has a 10 dollar note made of polymer. It is still unclear if more denominations will be issued in polymer.

Here's a nice article and profile of Dan Humphrey, one of the many people working at the Bureau of Engraving and Printing. He works on redesigning the US dollars and describes the ins and outs of his job.

The new €10 banknote will be unveiled on 13 January 2014 and start circulating later in the year. To draw attention to its security features, the European Central Bank has launched an online competition for European Union residents over 18 years old. Players have to uncover four of these security features and also guess the number of euro banknotes in circulation in the euro area on 31 December 2013. The competition closes at 11.59 p.m. CET on 12 January 2014.

The new €10 banknote will be unveiled on 13 January 2014 and start circulating later in the year. To draw attention to its security features, the European Central Bank has launched an online competition for European Union residents over 18 years old. Players have to uncover four of these security features and also guess the number of euro banknotes in circulation in the euro area on 31 December 2013. The competition closes at 11.59 p.m. CET on 12 January 2014.

The interesting thing are the awards:

A commemorative €10 banknote? I guess the presentation of the note in a frame or a folder will be the commemorative element because I doubt they will actually print a commemorative note.

Anyway, time to start playing!

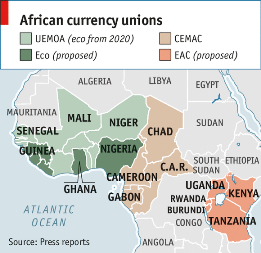

The Economist has a very interesting article on the growing number of currency unions in Africa. It talks about the differences between the unions, their chances for the future and of course, being The Economist, their biggest threats.

THE euro crisis has put most people off currency unions. But not in Africa, it seems. In November the leaders of five countries of the East African Community (EAC) agreed to form a monetary union within ten years. A month before West African politicians agreed on a plan to introduce a new shared currency, the eco, over the next few years. It should eventually subsume West Africa’s existing currency bloc—but not its central African cousin.

THE euro crisis has put most people off currency unions. But not in Africa, it seems. In November the leaders of five countries of the East African Community (EAC) agreed to form a monetary union within ten years. A month before West African politicians agreed on a plan to introduce a new shared currency, the eco, over the next few years. It should eventually subsume West Africa’s existing currency bloc—but not its central African cousin.

Under the proposal an initial group of six countries will adopt the eco by 2015 (see map). Five years later the members of the West African Economic and Monetary Union (known as UEMOA, its French acronym), which currently share a currency called the West African CFA franc, are to adopt the eco too, creating a currency union of over 300m people.

West African politicians are pushing for further integration because they, like most economists, argue that the single currency for UEMOA has been a qualified success. UEMOA member states are more fiscally disciplined than their neighbours outside the currency zone, says Cécile Couharde of the University of Paris Ouest Nanterre La Défense. The French government currently underwrites the West African CFA franc by guaranteeing to convert it to euros at a ratio of one to 0.0015. That has provided a stability rare in African currencies. Monetary unions also simplify trade: UEMOA has more intraregional trade than any other region in Africa, according to an IMF paper.

But the currency union has downsides. UEMOA economies move at different speeds. According to research by Romain Houssa, at the Catholic University of Leuven in Belgium, economic changes are poorly correlated between member states. From 2007 to 2012, the IMF found, the correlation between the business cycle of Senegal, a country with strong trade links outside the zone, and the other countries in UEMOA was almost zero.

Consequently, a UEMOA-wide interest rate is not ideal: as in the euro zone, some countries end up with the wrong rate. And an inflexible exchange rate makes economic adjustment difficult. From 2000 to 2012 average annual growth in output in UEMOA countries was about half that of comparable sub-Saharan economies, according to Gianluigi Giorgioni of Liverpool University.

Whereas UEMOA’s currency union has drawbacks, the proposed eco zone may have fatal flaws. It would encompass even more economic diversity. Nigeria in particular stands out. Its economy is huge by its neighbours’ standards. UEMOA’s GDP is about $75 billion; Nigeria’s is about $260 billion. The GDP of the next-biggest economy in the region, Ghana, is about $40 billion. And the Nigerian economy is unusual. Unlike most other West African countries it is heavily dependent on oil, which accounts for over a third of output, according to data from the OECD, a club of mostly rich countries.

IMF research shows that Nigeria’s balance of trade tends to move in the opposite direction to its neighbours’—they are largely importers of oil. During periods of high oil prices Nigeria may push for interest-rate rises. That would be disastrous for other eco-zone economies, which are likely to be gasping for lower rates.

To make matters worse the eco might be vulnerable to speculative attack. France would be unlikely to guarantee it, reckons Mr Giorgioni, as the liabilities would be large and the countries involved are not former French colonies. Without such support, investors would be nervous. Any fiscal laxity would be punished. If a region as rich as the euro zone has struggled to cope with such pressures, the likelihood that the poorer and less well-governed places hoping to adopt the eco could is tiny.

(© The Economist)

Hurrah! Yesterday marked the 90th anniversary of the end of German inflation.

Hurrah! Yesterday marked the 90th anniversary of the end of German inflation.

Here's a nice story on the background of this devestating time in German history. I also highly recommend this very readable Wikipedia page on this period and its economic and political background.

Every collector of banknotes who tries to get one note from every country has asked himself this question: just how many countries are there? Or in the case of us collectors: how many countries have there ever been who have issued paper money? The answer to the last question could be 361 according to some lists. Here's my list.

Every collector of banknotes who tries to get one note from every country has asked himself this question: just how many countries are there? Or in the case of us collectors: how many countries have there ever been who have issued paper money? The answer to the last question could be 361 according to some lists. Here's my list.

This however depends on your definition of what a country is. The Youtube channel CGPGrey (recommanded for a subscription!) has researched this question and made an entertaining video about it.

Just a quick reminder for all members of the IBNS to send in your nominations for Banknote of the Year 2013. This annual award has been won by Kazakhstan in 2011 and 2012 and their 2000 Tenge note which was released earlier this year has already been nominated for this year (along with the Mexican 50 peso and the 5 euro).

Just a quick reminder for all members of the IBNS to send in your nominations for Banknote of the Year 2013. This annual award has been won by Kazakhstan in 2011 and 2012 and their 2000 Tenge note which was released earlier this year has already been nominated for this year (along with the Mexican 50 peso and the 5 euro).

If you want some other winner and if you're a member of the IBNS (highly recommanded!) then please visit this page and send in your nominations.

The rules:

Banknotes nominated must have been issued to the public (specimens and non-circulating currencies are inelligble) for the first time during the year of the award, and must have artistic merit and/or innovative security features. When nominating a note, please provide your reasons for nomination, and if possible, a scan of the front and back of the note. Nominations for the award will be accepted up to the 31st January of the following year.

Personally I'm waiting for the new Canadian 5 dollar note which will be issued 7 November of this year and which, in my humble opinion, looks absolutely stunning.

There are countless subjects within the field of collecting banknotes which you can specialize in: one from each country, a specific country, birds, polymer, etc. etc. Coinweek looks at one subject in particular: the collecting of American $1 dollar notes.

Queen Elizabeth II has been the queen of England for... ages it seems! And yes, most of the country (or for that matter the world) has never seen another monarch in Buckingham Palace. In 2014 Elizabeth will celebrate her 88th birthday and her 62nd as queen. She has also been on banknotes throughout the world for 79 years, first appearing as an 8-year old girl on a banknote from Canada. The site Mental_Floss has made a list of 15 "Elizabeth-banknotes" from all over the world which show her ageing through the years.

Queen Elizabeth II has been the queen of England for... ages it seems! And yes, most of the country (or for that matter the world) has never seen another monarch in Buckingham Palace. In 2014 Elizabeth will celebrate her 88th birthday and her 62nd as queen. She has also been on banknotes throughout the world for 79 years, first appearing as an 8-year old girl on a banknote from Canada. The site Mental_Floss has made a list of 15 "Elizabeth-banknotes" from all over the world which show her ageing through the years.

For a complete list of all 30 portraits used on various banknotes in the Commenwealth, I highly recommend this list compiled by PJ Symes.

Next year, on 18 September 2014, Scotland will hold a referendum on the issue for independance from the Unitied Kingdom. One of the more intriguing questions (for collectors of banknotes at least) is what the currency of the new country will be if it chooses independance.

Next year, on 18 September 2014, Scotland will hold a referendum on the issue for independance from the Unitied Kingdom. One of the more intriguing questions (for collectors of banknotes at least) is what the currency of the new country will be if it chooses independance.

This article explores some of the options, looking back at the past (groat, plack, pistole), the present (Scottish Pound) or even the future (bitcoin).

My guess is they won't choose anything too fancy like the unicorn or the bitcoin so my money is on the Scottish pound.

Due to the turmoil surrounding the choice of Jane Austen for the next 10 pound banknote, the Mirror has investigated a number of countries and the presence of women on their banknotes. While it's a very arbitrary list, the results are that Australia with 6 women is the least sexist when it comes to their banknotes. Good to know, I guess?

Just a quick reminder that the renowned Paper Money Fair Maastricht will be held in the lovely town of Valkenburg a/d Geul in the south of the Netherlands in less then a month on 28-29 September 2013. Its autumn edition has 137 dealers signed to the event at this moment making this fair the largest of its kind in the world.

More info on the official website.

Here's an interesting article written by the legendary Peter Symes for Coinweek, describing the unintentional and intentional errors and oddities on world banknotes.